Hotline +256 800 232 700

Nairobi May 16th 2023…… Equity Group has weathered a turbulent macroeconomic environment to register a 21% growth with total assets reaching Kshs.1,537.7 billion. Funding the asset growth is a 23% growth in customer deposits with the proceeds deployed to grow loan the book by 21%. Customer deposits grew to Kshs.1,111.2 billion up from Kshs.900.9 billion while the loan book grew to Kshs.756.3 billion up from Kshs.623.6 billion.Speaking while releasing the Q1 2023 results, Dr. James Mwangi, Equity Group Managing Director and CEO said, “The strong growth speaks to the Group’s embedded social and trust capital that has seen the Group’s brand rated the 4th strongest financial brand on Earth. We are working to anchor the strength of the brand on customer experience, its capabilities and superior product offering.”

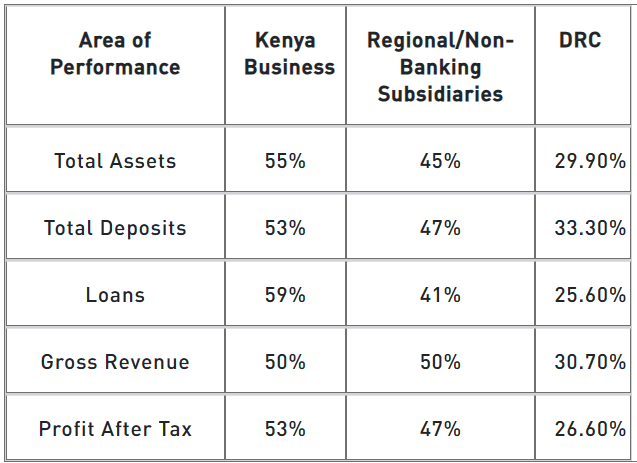

The Group’s regional expansion and product diversification strategy has delivered an almost 50:50 split of business between the anchor Kenya business and the regional banking subsidiaries and non-banking business.

“We have become a truly regional and diversified business,” added Dr. Mwangi.

- 98% of all transactions happen outside of the branch.

- 96% of all transactions are happening on 3rd party and self-service platforms delivering 70% of value of transactions.

- 87% of all loans are being processed on mobile channels.

- 82% of all transactions are cashless.

- Digital transactions grew by 23.3% to Kshs. 2,288.8 billion from Kshs. 1,856.6 billion while digital payments grew by 171% to Kshs 54.2 billion from Kshs 20 billion.

- 17% of Total Assets being cash

- 43% of Total Assets being cash and government securities

- 88% NPL Coverage in terms of provisions

- 1% loan to deposit ratio

- 5% Liquidity

- 8% Strong total capital to total risk weighted asset ratio.

Equity Group Managing Director and CEO, Dr. James Mwangi addresses analysts and guests during the Quarter One 2023 Investor Briefing event.

Equity Group Managing Director and CEO, Dr. James Mwangi (left), Equity Group Director, Strategic Partnerships, Collaborations and Investor Relations Brent Malahay (centre) and Equity Bank Rwanda Managing Director Hannington Namara (right) during the Quarter One 2023 Investor Briefing event.

Related stories

Equity Bank Uganda marks 10-year anniversary with a move to a state-of-the-art head office in Church House

Equity Bank Uganda has moved its Head Office to the ultramodern Church house building on 34 Kampala...

View MoreEquity Bank Unveils Its Digital Banking Solutions

The Eazzy Banking suite of products includes a banking app known as EazzyBanking App which allows...

View MoreEIB signs Kshs 10.45 billion support for East African entrepreneurs

The EIB is committed to supporting Kenyan Banks in providing credit to the young and growing...

View MoreEquity Bank’s differentiated strategy results in growth of the Bank’s size to nearly half a trillion on the backdrop of a challenging operating environment

The Group’s profit before tax grew to KShs 24.9bn from KShs 24.0 bn with the regional subsidiaries...

View MoreEquity Group secures its shareholders nod for a Kshs 20 billion pan African expansion bid

The approvals, which were secured during the firm’s 11th Annual General Meeting (AGM) held today...

View MoreEquity's Partnership With Kyamuhunga Uplifts Tea Farmers

The factory, commissioned by Uganda’s President, H.E. Yoweri Kaguta Museveni has so far exported...

View MoreEquity Bank Unveils MVNO strategy and rollout plan

Equity Bank today unveiled its Mobile Virtual Network Operator (MVNO) strategy and rollout plan...

View MoreEquity Bank profit before tax up 21 percent in first quarter 2013

The Group posted a profit before tax of Kshs 4.52 billion up from Kshs 3.73 billion posted during a...

View MoreEquity Bank's Strategy Increases Profits by 36 percent

The Group’s total assets posted a 24% growth during the year to close at Ksh 243 billion up from...

View MoreMasterCard and Equity Bank Announce Partnership to Introduce PayPass™ Enabled Cards

Partnership to increase financial inclusion and boost EMV migration efforts in the region.

View MoreOrange launches Visa card in partnership with Equity Bank

Orange launches Visa card in partnership with Equity Bank.

View MoreEquity Bank CEO joins Global Alliance for Food Security and Nutrition

Equity Bank Group CEO, Dr. James Mwangi has joined the Global Alliance for Food Security and...

View More21 Equity Bank Scholars receive scholarships to study in world leading universities in 2012

21 scholars in the Equity Bank university sponsorship program have so far received scholarships in...

View MoreEquity Bank profit before tax grows by 29%

During the period under review, Equity Bank Group’s loan book grew by 27% from Kshs 97.7 billion...

View More250 Top KCSE scholars to benefit from Equity Bank's university sponsorship programme

Two hundred and fifty top performers in last year’s Kenya Certificate of Secondary Education are...

View MoreEquity Bank Group and IFC Team up to Expand Access to Finance in East Africa

International Finance Corporation (IFC), a member of the World Bank Group, today extended a Kshs 8.3...

View MorePurchase for Progress November Update Access to Finance

This issue focuses on access to finance. It includes two articles from the field (Kenya and El...

View MoreEquity Uganda officially unveils a new brand identity aimed at charting sustainable growth.

Equity will now present itself as a unified brand with a consolidated business model for its...

View MoreEquity Bolsters its Support to Small and Medium Sized Enterprises in Kenya, Uganda, Rwanda & DRC with USD 75 Million (Kshs 8.25 Billion) Women Guarantee Fund with African Guarantee Fund (AGF)

The African Guarantee Fund (AGF) and Equity Group Holdings Plc have signed an agreement which will...

View MoreUnited Nations Uganda and Equity Bank Uganda establish new partnerships for acceleration of attainment of the SDGs

The new partnership will promote social inclusion and improve economic outcomes for human...

View MoreEquity Bank Uganda Donates 2,000 Mosquito Nets Worth UGX 40 million for Market Vendors Towards the Fight against COVID-19

This contribution is in addition to what the Bank had previously donated to the COVID-19 task force...

View MoreEquity Bank unveils EazzyFX, an electronic channel for settling forex transactions

Equity Bank has today unveiled EazzyFX, an innovative electronic channel that allows customers...

View MoreEquity receives double International Standards Certification on IT Service and Information Security Management Systems

Equity Bank Kenya Limited has received two International Standards Certifications - ISO 20000 and...

View MoreEquity Bank Uganda launches account opening via *247#

This game-changing innovation will help many underserved and unbanked customers access banking...

View MoreEquity Group Launches Kshs. 678 billion (USD 6 Billion) Regional Private Sector Economic Recovery and Resilience Stimulus Plan

Equity’s Eastern and Central Africa Recovery and Resilience plan is envisaged to provide financing...

View MoreEquity Group Returns to Growth

Equity Group has eased its defensive strategy that had been deployed during the economic uncertainty...

View MoreEquity Bank Uganda signs MOU with Uganda National Oil Company

This MOU will also see Equity provide financial service solutions for UNOC and its value chain.

View MoreEQUITY BANK UGANDA LAUNCHES EQUI-GREEN LOAN FINANCING FOR RENEWABLE CLEAN TECHNOLOGIES

The aim of the Product is to enable Ugandans access electricity in off grid areas by addressing the...

View MoreEquity Bank signs MoU with Bunyoro Kitara Kingdom

The parties shall work to scale up financial inclusion and shared prosperity through financial...

View MoreTHE AFRICAN CONTINENTAL FREE TRADE AREA (AfCFTA) SECRETARIAT AND EQUITY GROUP CEMENT A PARTNERSHIP TO DEEPEN ECONOMIC INTEGRATION OF THE AFRICAN CONTINENT

The partnership will champion the implementation of the Africa Recovery and Resilience Plan which...

View MoreEquity Bank Uganda Launches a High-Tech contact centre

As one of the strategies to further improve customer experience and deliver services to its...

View MoreEquity Bank Uganda signs MOU with Bukoola Chemical Industries Ltd

Equity Bank Uganda and Bukoola Chemical Industries Ltd, today, signed a Memorandum of Understanding,...

View MorePresident Museveni Commissions Dei Biopharma Pharmaceutical and Vaccine Plant

Equity Bank provided up to US$100 million funding for construction, importation of Hi-Tech Medical...

View MoreEQUITY BANK UGANDA LIMITED APPOINTS ANTHONY KITUUKA AS MANAGING DIRECTOR

Equity Bank Uganda Limited has announced the appointment of Mr. Anthony Kituuka as the new Managing...

View MoreEQUITY GROUP REPORTS STRONG 3RD QUARTER PERFORMANCE

Equity Group Holdings Plc today reported Kshs.34.4 billion shillings profit after tax for the nine...

View MoreEquity Bank Uganda starts disbursing funds to Savings and Credit Co-Operative Societies under PDM

The Savings and Credit Co-operative Societies will also get free Financial Literacy and Business...

View MoreInnovative Minds Set to Soar: Equity Bank Launches Innovation Hub to Empower Future Tech Leaders

Kampala, Tuesday 23rd July 2024: Fifty exceptional university students are set to embark on...

Read MoreEQUITY GROUP RANKED THE WORLD’S 4TH STRONGEST BANKING BRAND

Equity Group, East and Central Africa’s largest financial institution, has enhanced its position...

View MoreEQUITY GROUP REPORTS A RECORD KES 46.1B NET PROFIT AND A DIVIDEND PAYOUT OF KES 15.1B

EQUITY GROUP REPORTS A RECORD KES 46.1B NET PROFIT AND A DIVIDEND PAYOUT OF KES 15.1B

View MoreEquity Bank launches Equi-Mama- a Product for Women in Business

Equi-mama credit facility aims to provide women with access to affordable capital, equip women with...

View MoreEQUITY BANK UGANDA ADMITS ITS SECOND COHORT OF 102 TOP-PERFORMING SCHOLARS TO THE EQUITY LEADERS PROGRAM

The Equity Leaders Program has been designed uniquely and will also offer the scholars an...

View MoreInterswitch And Equity Bank Enter A Strategic Partnership

Interswitch and Equity bank are pleased to announce a partnership that will give Equity customers...

View MoreEquity Bank Revolutionizes Business Financing with the Launch of Stock Financing

The product targets agents, distributors, stockists or retailers who are onward sellers of products...

View MoreABAKYALA KU NTIKKO: Equity Bank Enabling Women in Small-scale businesses to achieve financial Growth

Throughout March, Equity Bank has honoured women nationwide with a series of events designed to...

View MoreEQUITY BANK UGANDA COMMISSION THIRD COHORT OF EQUITY LEADERS PROGRAM (ELP) BY ADMITTING 110 TOP-PERFORMING SCHOLARS

Equity Bank Uganda has today commissioned its third cohort of Equity Leaders Program (ELP) scholars,...

Read MoreEquity Group Holdings Registers Strong Recovery

Nairobi Monday 13th May 2024…… After reporting a 5% decline in profit after tax for the year...

Read MoreEquity Bank Engages SMEs in ‘Tupange Business Ne Equity’ Initiative

Following the national budget reading for the financial year 2024/2025, Equity Bank Uganda has...

Read MoreEquity Group Strengthens Partnership with Zepz to Support Diaspora Client Base with Ease

Nairobi, Kenya | 15th July 2024... Zepz, the group powering leading global remittance brands,...

Read MoreEquity Bank Uganda marks 10-year anniversary with a move to a state-of-the-art head office in Church House

Equity Bank Uganda has moved its Head Office to the ultramodern Church house building on 34 Kampala...

View More113 Scholars Under the Equity Leaders Program (ELP) Join Top Global Universities

Kampala, 14th August 2024: 113 Equity Leadership Program scholars have secured admission and...

View moreEquity Group Holdings PLC Reports Half Year Profit After Tax of Kshs 29.6 Billion

Nairobi, 12th August 2024: Against a backdrop of continued macroeconomic headwinds of high interest...

Read MoreEquity Bank and Church of Uganda Celebrate Successful Payment of Church House Loan

Equity Bank has pledged to continue its strong collaboration with the Church of Uganda and other...

View MoreEquity Group Unveils 2023 Sustainability Report: “A Sustainable World is a Transformed Africa” Showcasing Bold Vision and Impact

Nairobi, Kenya, 3rd September 2024: Equity Group unveiled its third annual sustainability report for...

View moreEquity Bank and Confederation of Indian Industries Launch India-Uganda Trade Mission to Boost Bilateral Trade and Investment Opportunities

Kampala, Uganda, 22nd October 2024: Equity Bank, in partnership with the Confederation of Indian...

Read MoreEquity Bank, Kenya High Commission & Mwirians join hands to restore forest cover on Mwiri Hill with 43,000 indigenous trees

Equity Bank in partnership with the Kenya High Commission and Million Trees International has...

Read MoreEquity Group Holdings Plc Reports 3rd Quarter 2024 Profit After Tax of Kshs 40.9 Billion

NAIROBI, 12th November 2024: Against a backdrop of continued macroeconomic headwinds of high...

Read MoreEQUITY BANK UGANDA ANNOUNCES THE EXIT OF MANAGING DIRECTOR ANTHONY KITUUKA

Equity Bank Uganda Limited (EBUL) has announced the resignation of Mr. Anthony Kituuka as the...

Read MoreEquity Bank Uganda Limited Appoints Gift Shoko as Managing Director

Kampala, Uganda – 14th January 2024: Equity Bank Uganda, a subsidiary of Equity Group Holdings Plc...

Read More29 Scholars from Equity Leaders’ Program Graduate from University

Kampala, Uganda –3rd February 2025 – Equity Bank Uganda has celebrated the graduation of its...

Read MoreEquity Group Reports Kshs 60.7 Billion Profits Before Tax, Driven by Strategic Diversified Growth

NAIROBI, 27th March 2025: Equity Group Holdings Plc continues to deliver solid financial results,...

Read MoreEquity Bank Launches Second Edition of Abakyala Ku Ntiiko to Empower Women in Businesses

Following the resounding success of its inaugural edition in 2024, Equity Bank has launched the...

Read MoreEquity Bank Commissions 100 Students to the Equity Leaders’ Program

Kampala, Uganda –10th May 2025: Equity Bank Uganda has today commissioned 100 scholars as the...

Read MoreEquity Launches Affordable Hospital Cash Insurance for All

KAMPALA, 03rd April 2025: In a landmark move to enhance financial security and healthcare access for...

Read MoreEquity Group Reports Kshs 15.4 Billion Profits After Tax on Prudent Cost Management and Resumption of Growth

NAIROBI, 29th May 2025: Demonstrating strategic agility and resilience in a dynamic global economic...

Read More128 Scholars Under the Equity Leaders Program (ELP) Join Top Global Universities

NAIROBI, 14th August 2025: 128 Equity Leadership Program scholars have secured admission and...

Read MoreEquity Group Announces Strong Q3 2025 Results, Recording a 32% Growth in Profit After Tax Reflecting Strategic Transformation

Nairobi, 30th October 2025: Equity Group Holdings Plc has announced its Q3 2025 results, showcasing...

Read More