Hotline +254-763-000-000

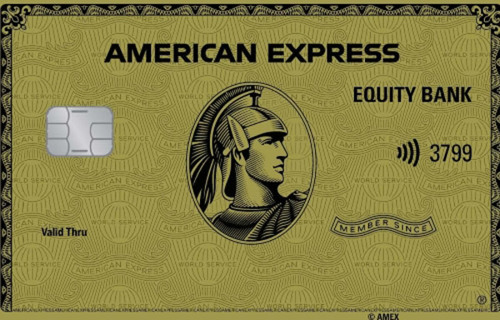

American Express (Amex) Credit Cards

Great Benefits

The Equity Bank American Express® Green Card

- Earn Membership Rewards® points when you spend online, at merchant locations and when you withdraw cash from ATMs. Redeem your points for travel offers, retail items, electronics, gift vouchers and more

- Accepted in Kenya and worldwide

- Easily track and manage your spend and payments with an online Card Account

- Travel insurance and purchase protection

- Cover against personal belongings theft

- Pay your balance off over time by choosing how much to pay each month (20%, 50% or 100%)

- 50 days interest-free credit

- Your first supplementary Card is free

- Earn 1,000 Membership Rewards® points when you spend KES 30,000 in your first three months of Cardmembership.

The Equity Bank American Express® Gold Card

- Equity Bank American Express® Green Card benefits

- Enhanced travel insurance and purchase protection

- Your first two supplementary Cards are free

- Priority Pass membership, with two complimentary visits to airport lounges per year

- Earn 8,000 Membership Rewards® points when you spend KES 150,000 in your first three months of Cardmembership.

-

-

How to Apply

Visit your nearest Equity Bank branch or apply on the link below.

-

Membership Rewards

Earn Membership Rewards points when you spend at businesses, shop online or withdraw cash from ATMs. Earn 1 Membership Rewards point for every KES 100 you spend at merchants and online. Earn 1 Membership Rewards point for every KES 500 you withdraw at the ATM. Redeem your points for a range of items, including must-have products, gift cards, car rentals and flights. Visit the Membership Rewards website for more information: https://rewards.equitybankgroup.com/

Equity Gold Credit Card

The Equity Gold Credit Card gives high income earners the freedom to enjoy higher spending limits and exclusive packages.

8 Great Features of The Gold Card

- The card’s chip and PIN feature means increased security while transacting. Your information will be stored in the chip while your PIN verifies your transaction.

- The card is acceptable worldwide at all Visa branded outlets.

- You will incur no transaction charges while paying for goods or services at merchant outlets.

- The Gold Card allows you to withdraw money from an ATM.

- Each time a transaction takes place, you will receive an SMS notification giving details of the transaction.

- The card operates on revolving credit with a 45-day interest free period, and an allowance to pay back each month 20% or more of the outstanding balance.

- We conveniently keep itemized monthly statements, giving you a breakdown of the transactions made and their corresponding times.

- The Gold Card gives you access to affordable life insurance for you and your family.

10 Reasons Why You Should Get a Gold Card

- It comes in handy during emergencies.

- The card is useful for purchasing big ticket items.

- It gives you the freedom to travel without physical cash.

- The card is useful for corporate spend.

- It provides security while making big purchases, because you don’t have to have the money on you physically.

- The revolving credit feature puts a cap on the amount of credit you can use for that month.

- You have the flexibility to pay off the total amount owed or spread it across a period of time.

- As you continue spending, the amount of credit available is reduced.

- Statements allow you to keep a record of your spending.

- You will get to enjoy occasional discounts from select outlets.

Equity Classic Credit Card

8 Great Features of the Classic Card

- Instead of having to sign a sales slip, your PIN verifies your transaction.

- There’s worldwide acceptability of Visa Brand, meaning you can access your funds at all VISA branded outlets.

- You can pay for goods and services at supermarkets, hotels, hospitals, fuel stations, and other retail outlets at no charge.

- Your card allows you to withdraw cash from the ATMs.

- Every time you transact you will receive an SMS alert with details of the transactions as they happen.

- Enjoy revolving credit with a 45-day interest free period. You may pay as little as 20% or more of your outstanding balance every month.

- Enjoy convenient record keeping through itemized monthly statements which show your transaction details.

- With the Classic Card you get access to affordable life insurance for you and your family.

10 Reasons Why You Should Sign Up for The Classic Card

- The Classic Card is useful during emergencies.

- The card is useful for purchasing big ticket items.

- The card is suitable for corporate spend.

- It gives you the freedom to travel without physical cash.

- It provides security while making big purchases, because you don’t have to have the money on you physically.

- The revolving credit feature puts a cap on the amount of credit you can use for that month.

- Your available credit is reduced by the amount you spend.

- You may choose to pay off the total amount spent at the end of each month or spread the cost over time.

- You can keep a record of your spending through statements.

- You will get to enjoy periodic discounts from selected shops.

Bill Settlement

To settle your outstanding credit card bills, use one of the following options

1. Cash Deposit into your account

The credit card outstanding balance will be deducted from the account.

2. Cheque Deposit

Deposit a cheque in favour of VISA CREDIT CARD PAYMENT ACCOUNT OR AMEX CREDIT CARD PAYMNENT ACCOUNT at any Equity branch, upon clearing of the cheque the credit card outstanding balance will be paid off.

3. Equitel

Use the below steps:

Step 1: Link your card: Go to Equitel → My money →My account→ add account /card →link my other account/card→ Link my other card→ key in the card number →Input the card PIN→ Enter Alias Confirm the linkage details.

Step 2: Repay your outstanding bill: Go Equitel → My Money→ Send Money → Select Account → Select to my accounts → Select the card (Alias) → Input the amount→ Confirm the transaction details→ Enter PIN→ Confirm payment.

-

4. Equity Mobile/Online

Log into the App → Click on the 3 horizontal bars at the top left of the page → Click on My cards →Select pay to card →Transfer funds from account to card → Input the amount & PIN to complete the transaction.

-

5. Mpesa

Go to Mpesa →Lipa Na Mpesa →Pay bill

→Enter Business number 247247

→ Enter account number (VISA credit card payment account 0810297000152 or American Express credit card payment account 0810263450692)

→Enter amount →Enter Mpesa PIN →Confirm payment.

More on Credit Cards

Key Features

- PIN for POS &ATM transactions

- Contactless

- 3D secure for Ecommerce transactions.

- Embossed

- International acceptance

Why You Should Get an Equity Credit Card

- Offers convenience in making payments and access to cash for 24 hours.

- Worldwide acceptance

- Utilize bank approved credit limits.

- Flexible repayment plans

- SMS alerts for card transactions

Charges

Rights and Obligations

- T & Cs of products are available on website and as part of account opening form.

- Data privacy policy included in customer onboarding and account opening forms

-

What You Require to Sign Up

- Existing approved credit limit or cash cover.

- KRA PIN

- Original and copy of national ID /passport.

-

Transaction Process

- Real time Credit cards transactions for approved transactions. Billed later on the credit card statement.

-

Complaints Handling Process

- Lodge complaint at any of our branches, via call center, info@equitybank.co.ke or website: https://equitygroupholdings.com/ke/. We will record your feedback and issue you with a reference number.

- We will acknowledge you feedback within 48hours.

- If we cannot resolve the complaint immediately, we will advise on the next cause of action and when to expect feedback from us.

- We will endeavor to resolve the complaint within 7 working days. However, should we require more time to it, we will keep you updated with progress every 7 days until the complaint is resolved.

- Should the resolution not meet your satisfaction, feel free to get back to us with your concerns and we will review the issue and resolution and revert to you.

-

Potential Risks

- Do not share PIN with anyone.

- If the card is suspected to be compromised, change the PIN at an ATM location.

- Avoid sharing your full card number, expiry date and card verification value with anyone

- Always keep your cards safe. In case the card is misplaced/lost, this should communicate to the bank to block the card immediately .The cardholder can also self-block the card through the Equity APP.

We would like to call you back regarding this product.

Tools to enable you transact with ease

Equitel

Equity Mobile

Equity Online

Equity Online for Business

EazzyFX