- Equity bags 22 accolades including Best Overall Bank in Kenya, Bank with the lowest charges for individuals, Best Bank in Agriculture and Livestock Financing and Best Bank in Mobile Banking among others.

- The Bank retains Best Bank in Sustainable CSR for 5 years in a row & Young Banker of the Year for the third time.

- This win validates Equity's strategy of delivering digital banking and an unrivalled customer experience.

2nd June 2021… Equity Bank Kenya has received 22 accolades in the 2021 Banking Awards by Think Business cementing the bank’s position as the leading bank in Kenya.

For the 10th year in a row, Equity was ranked Best Overall Bank in Kenya and Best Bank in Sustainable CSR for the 5th year running.

The Bank also garnered first position in 10 other categories which included Best Tier 1 Bank, Best Bank in Trade Finance, Best Bank in Agriculture and Livestock Financing¸ Best Bank in Asset Finance, Best Bank in Mobile Banking, Best Bank in Product Innovation, Best Bank in Agency Banking, Best Bank in Internet Banking, Best Commercial Bank in Microfinance and Bank with the lowest charge for individuals.

Equity took 1st runner up position in 4 categories including Best Bank in SME Banking, Best Bank to borrow from, Best Bank in Mortgage Financing and the Special Judges Award for Product Innovation for the Kenya Cereal Enhancement Programme Climate-Resilient Agricultural Livelihoods Window (KCEP-CRAL), e-voucher mobile program targeting smallholder farmers and agro-dealers.

Additionally, Equity took third place in the Best Retail Bank, Best Bank in Digital Banking and Most Customer-Centric Bank award categories reinforcing the brand’s positioning as a people-centred, digital bank and the bank for all irrespective of the sector or segment they are in.

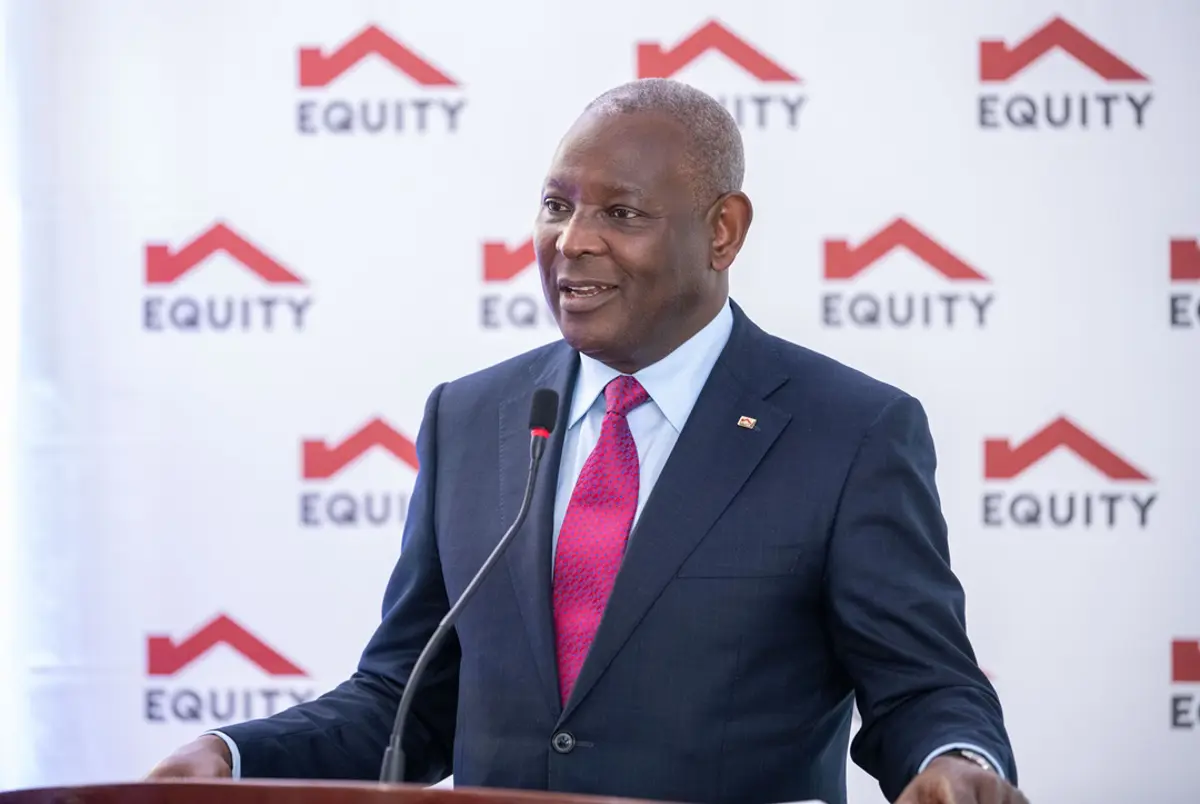

In the leadership categories, Equity Group MD and CEO Dr. James Mwangi was crowned CEO of the Year for his contribution to financial inclusion, for steering the dynamism of the region’s banking sector and for his role in championing corporate social investment in the various communities that Equity operates in. Dr Mwangi has been feted CEO of the Year for 5 years now since 2017.

Edwin Kiburu, who serves as a Technical Product Manager in charge of Lifestyle Payments also won the Outstanding Young Banker Award marking the 3rd year that Equity has bagged the award. A testament that Equity is passionate about professional youth empowerment, leadership development and mentorship.

While receiving the awards in a virtual ceremony, Equity Bank Kenya Managing Director Gerald Warui commented on the win saying, “The recognition by the Think Business Banking Awards has reinforced our position in the market as a bank that customers have trusted, a bank that listens and cares for customers, a bank that enables businesses to grow and thrive, a progressive bank that offers self-service digital solutions and a bank that is responsive to the market and customer needs.”

Gerald further added that Equity remained committed to investing in innovation, processes, systems and in staff to spearhead the progress, dynamism and digitization of the banking sector for a better Kenya and Africa at large.

“We are strong advocates of the shared prosperity model and we continue to leverage our commercial infrastructure to implement social impact programs implemented through Equity Group Foundation (EGF). The Wings to Fly program and Elimu scholarship programme have continued to have an impact on young people who excel in their academic pursuits while also demonstrating leadership capabilities. Other impactful programs aligned to our social impact thematic areas include Equity Afia, the medical franchise of EGF, 35 million trees tree-planting initiative and financial education and entrepreneurship among others.” added Mr. Warui.

The Banking Awards by Think Business, which have been running for the past 16 years, are organized by Think Business Limited, strategic research and competitive intelligence company specializing on the financial sector. The main objective of the Awards is to encourage innovation, prudence and stability in the banking sector by recognizing, awarding and celebrating exemplary performers.

Commenting on Equity’s win, Think Business CEO, Ochieng Oloo said, “By showcasing the best performers in the industry, we aim to present the banking public with an opportunity make informed banking decisions. Equity has emerged top in a closely contested process that saw multiple industry players submit entries for consideration.”

2021 Think Business Awards

|

Brand

|

1. Best Overall Bank – 10 years running

2. Best Bank in Tier 1 – 7 years running

3. Best Bank in Sustainable CSR – 5 years running

4. Best Bank with the Lowest Charge for Individuals – 5 years running

5. Most Customer Centric Bank – 2nd runners up

6. Most Customer Centric Bank in Tier 1 – 2nd runners up

|

|

Franchise Segment

|

7. Best Bank in Mobile Banking

8. Best Bank in Product Innovation

9. Best Bank in Agency Banking

10. Best Bank in Internet Banking

11. Best Commercial Bank in Microfinance

12. Best Retail Bank – 2nd runners up

13. Best Bank to Borrow from – 1st runners up

14. Best Bank in SME Banking – 1st runners up

|

|

Product

|

15. Best Bank in Trade Finance

16. Best Bank in Agriculture and Livestock Financing

17. Best Bank in Asset Finance

18. Special Judges award for Product Innovation – 1st runners up

19. Best Bank in digital banking – 2nd runners up

20. Best Bank in mortgage finance – 1st runners up

|

|

Leadership

|

21. CEO of the Year Award – Dr. James Mwangi

22. Outstanding Young Banker of the Year- Edwin Njoroge Kiburu

|

About Equity Bank Kenya

Equity Bank Kenya is the largest bank subsidiary of Equity Group Holdings Plc with a footprint of 190 branches, spread across the country and is supported by over 39,464 agents, 21,138 merchants and 398 ATMs. Equity Group Holdings Plc is a financial services company listed at the Nairobi Securities Exchange, Uganda Securities Exchange, and Rwanda Stock Exchange. In addition to Equity Bank Kenya, the Group has banking subsidiaries in Uganda, South Sudan, Rwanda, Tanzania, DRC and a Commercial Representative Office in Ethiopia; with additional non-banking subsidiaries engaged in the provision of investment banking, custodial, insurance agency, philanthropy, consulting, and infrastructure services.

Equity Group is the biggest bank in asset base in the region with nearly Kshs 1.1 trillion assets. The Group is also the biggest in customer base with 15 million customers as well as in deposits profitability and market capitalisation. The Group has a footprint of 336 branches, 53,151 Agents and 34,862 Merchants and 725 ATMs. The Group is the largest bank in market capitalization in East and Central Africa. The Banker Top 1000 World Banks 2020 ranked Equity Bank 754 overall in its global ranking, 62nd in soundness (Capital Assets to Assets ratio), 55th in terms of Profits on Capital and 20th on Return on Assets. In 2020, Equity was ranked position 7 in the list of top 10 banks in Africa in The Banker’s Top 100 African Banks, becoming the 1st bank in Eastern and Central Africa to achieve this milestone, paving way for East African banks to play in the league of big banks together with South Africa, North Africa and West Africa. The bank was ranked 5th on soundness, 9th on growth performance, 8th in return on risk, and 6th on profitability.

In the same year, Moody’s gave the Bank a global rating of B2 with a negative outlook same as the sovereign rating of the Kenyan government due to the Bank’s strong brand recognition, solid liquidity buffers and resilient funding profile, established domestic franchise and extensive adoption of digital and alternative distribution channels.

Equity Group Holdings Plc is regulated by the Central Bank of Kenya.